》View SMM Aluminum Product Prices, Data, and Market Analysis

》Subscribe to View SMM Historical Spot Metal Prices

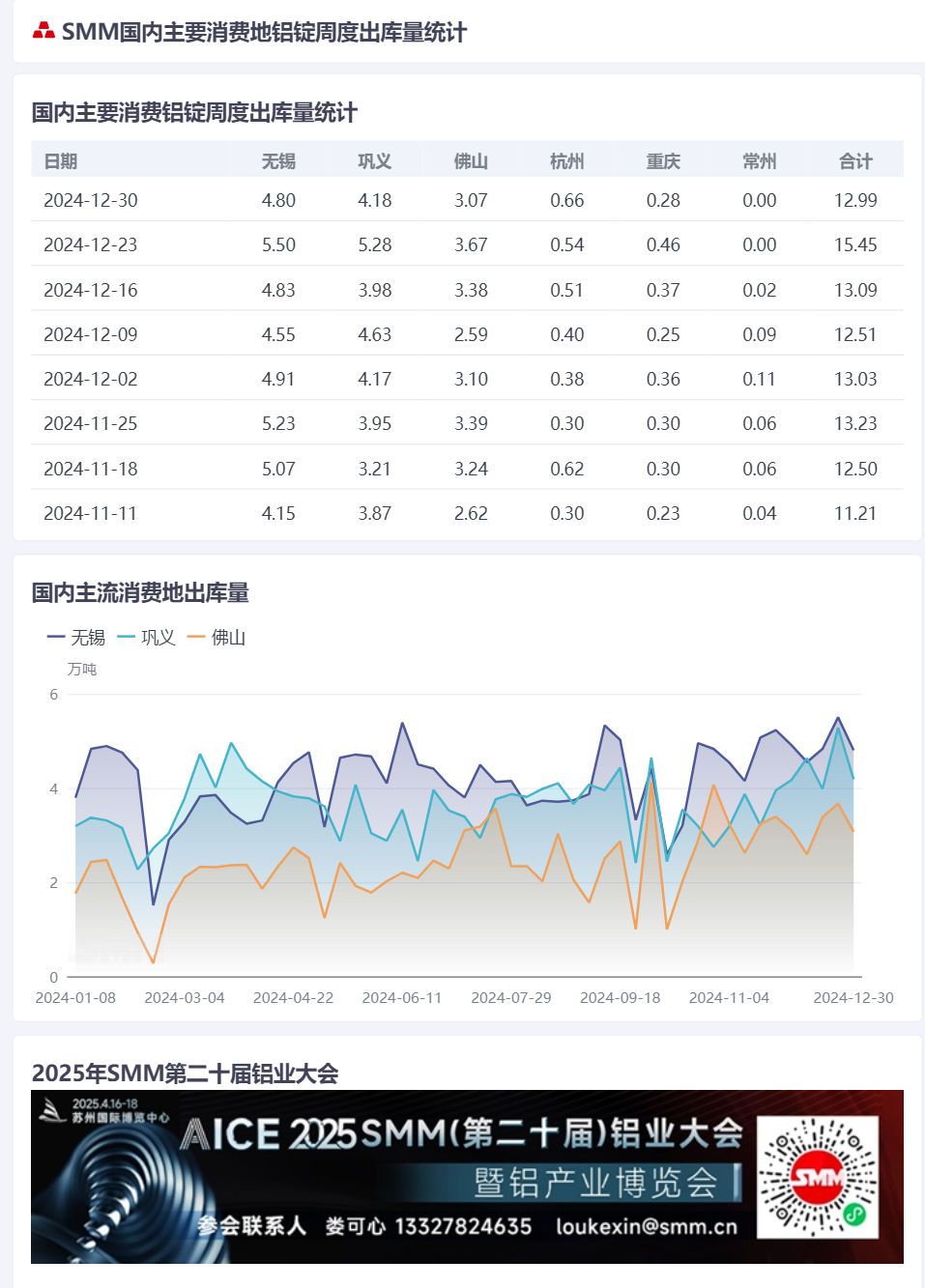

In terms of aluminum ingot inventory, despite the continued off-season atmosphere in domestic aluminum demand, the latest aluminum ingot inventory statistics for 2024 showed no inventory buildup due to most shipments from Xinjiang being in transit and not yet arrived. According to SMM statistics, as of December 30, 2024, the social inventory of domestic aluminum ingots was 490,000 mt, and the inventory of marketable aluminum ingots was 364,000 mt, remaining stable WoW. On a YoY basis, the current domestic aluminum ingot inventory was still 56,000 mt higher than the same period last year. Regarding outflows from warehouses, SMM statistics showed that last week, domestic aluminum ingot outflows from warehouses dropped significantly by 24,600 mt to 129,900 mt MoM. As some downstream sectors have stopped taking orders at year-end, the record high outflows from the previous week seemed like a "flash in the pan," with aluminum ingot outflows pulling back significantly over the past week to normal levels.

Regarding the latest situation of shipments from Xinjiang, SMM's latest survey indicated that station shipments have mostly returned to normal, with sufficient transportation capacity. The earlier concentrated coal shipments from Xinjiang have temporarily subsided due to price declines. Except for a small amount of residual inventory at some aluminum plants, the backlog in Xinjiang has been largely cleared. Last week, SMM's aluminum research team conducted an on-site survey at a warehouse in Foshan. Currently, aluminum inventory in the South China market has reached its lowest point of the year, with aluminum ingots mainly coming from Guangxi, Yunnan, and small quantities from other regions. Although no Xinjiang-origin aluminum was observed, the warehouse reported that the volume of shipments in transit from Xinjiang has increased recently, and an inventory buildup turning point is expected after the New Year.

Although the December aluminum price correction exceeded expectations in boosting spot outflows, the overall off-season atmosphere in domestic aluminum demand persisted, with some downstream sectors stopping orders at year-end. Meanwhile, aluminum prices below 20,000 yuan are likely to become the norm around the Chinese New Year period, and downstream purchasing interest has gradually waned, making a strong rebound in aluminum ingot outflows unlikely. Regarding arrivals, most shipments from Xinjiang are still in transit and have not yet arrived. A peak in concentrated arrivals is expected later this week and next week, which may significantly increase pressure in the spot market. SMM expects the turning point for domestic aluminum ingot inventory to likely occur in early January. In January, domestic aluminum ingot inventory is expected to hover around 500,000-600,000 mt, with the risk of sustained inventory buildup increasing. Close attention should be paid to changes in downstream operating rates before the year-end holidays and whether the boost to spot outflows from the aluminum price correction continues.

Over the weekend, aluminum billet inventory and outflows showed initial turning points, aligning with expectations from the downstream consumption side. Regarding aluminum billet inventory, concentrated arrivals were observed over the weekend due to a significant increase in shipments in transit from north-west China, including Xinjiang and Ningxia. According to SMM statistics, as of December 23, domestic social inventory of aluminum billets was 99,000 mt, a significant inventory buildup of 9,900 mt WoW, approaching the 100,000 mt threshold again. The previously tight supply of aluminum billets has been noticeably alleviated. On a YoY basis, the gap compared to the same period last year widened to 34,900 mt, remaining at a three-year high for the same period. Regarding outflows from warehouses, last week, aluminum billet outflows from warehouses dropped sharply by 8,300 mt to 39,300 mt MoM. Although some downstream sectors had shown interest in year-end restocking at lower prices earlier, weak downstream operating performance, combined with the impact of high processing fees, has suppressed the sustained strong performance of aluminum billet outflows compared to aluminum ingots.

SMM expects that due to the increasingly evident off-season atmosphere in the aluminum extrusion sector, operating rates for aluminum extrusion enterprises will continue to fluctuate downward. At year-end, domestic aluminum billets are expected to remain in a weak supply-demand balance. With signs of backlog alleviation in Xinjiang, shipments of aluminum billets to east and south China are expected to increase significantly, and subsequent arrivals may see notable replenishment. Domestic aluminum billet inventory is likely to remain stable or slightly increase within the month, with the inventory level returning to the 100,000 mt threshold by month-end being almost certain. Close attention should also be paid to changes in downstream operating rates before the year-end holidays and whether the boost to spot outflows from the aluminum price correction continues.

On the demand side for aluminum billets, this week, operating rates for domestic aluminum extrusion enterprises showed mixed performance but overall reflected a declining trend in the off-season, recording 47.10%, down 0.90 percentage points WoW. SMM learned that operating rates in South China showed slight increases, mainly due to some orders being placed after aluminum prices fell below 20,000 yuan, with some aluminum extrusion plants receiving bathroom-related orders. Automotive extrusion orders in the industrial sector were moderate. Operating rates varied significantly in other regions, with some plants focusing on clearing orders on hand after earlier payment collection efforts, driving operating rates upward. However, most enterprises maintained stable operating rates. Notably, PV production schedules are expected to weaken further, with leading suppliers also showing significant declines in operating rates and planning for holidays. Overall, with aluminum prices running at low levels, downstream sectors continue to place orders based on rigid demand, making it difficult for operating rates to improve under off-season conditions.